The information stated in The Value Investing Knight ("The Blog") should not be used as a reference to buy or sell any securities, assets or commodities mentioned. Readers should carry out their own due diligence and validation of any information shown in The Blog. The owner of The Blog is not liable for any loss arising directly or indirectly as a result of actions taken based on ideas and information found in The Blog.

It has been almost 3 months since my last post. Apologies for the missing in action over these 3 months! I was slighltly pre-occupied with pre-merger preparations with my real-life princess. Nevertheless, this should not be used as excuse for my infrequent blog posts. But it doesnt mean I have stopped the quest to search for new princesses to rescue. Another reason for the MIA is that there are fewer deeply valuable companies around for us to uncover so I really need to expand to other markets to search harder.

This post is to update that Nobel Design has received a mandatory unconditional cash offer of S$0.51 per share (S$0.5048 after netting off proposed dividends) from Grand Slam RF18 Investments Pte Ltd (Grand Slam). This is the link to the full offeror's announcement. Grand Slam is an investment holding company which has the following shareholding interests. Looks like these shareholders are great Tennis fans! Jokes aside, we have to be wary of investing in other companies which they are management (luckily there are not many around) because they are placing their best interests at heart instead of the shareholders' interests..

In my previous post on Nobel Design (ND), the company was holding net cash of SG$115.59 mil ($0.54 per share) and in the latest Q1 financials as at 31 March 2017, the net cash level has increased to SGD121.9 mil ($0.56 per share) and the Shareholders' Equity is SG$161.9mil ($0.74 per share).

What is it showing here??? The management has the cheeks to offer a buy-out price at below the net cash level!!! This seems to be outright daylight robbery, trying to rob the other shareholders of their share of $$$ in the company!

Sadly and unfortunately, this management buyout did not manage to unlock the full value of ND, not even close to the NAV level. At $0.51 price level, the Price to book is at 0.69... By offering a cash offer lower than the net cash level, I really wonder what signals the management are trying to send out. Are you saying that your $0.51 per share is more worthwhile than the net cash deposits of $0.56 in the company? Grand Slam still claims that there is compelling premium over the prevailing market prices and this is an unique cash exit opportunity for shareholders (I guess they are referring to their unique opportunity to cash out).

I have to agree that this counter has very low liquidity and the bid-ask spread is about S$0.05 to S$0.08. I had been queueing at $0.40 for the past months and hence, I was not allocated to any so I am totally not vested.. I would be very interested to see what the Independent Financial Advisor has to say for this offer price. But I urge all shareholders to consider this offer seriously and REJECT THE OFFER if you think that the offer should at least match the net cash level (even though personally, I think the intrinsic value should be higher than the net cash level).

Anyway, one of the majority shareholders who is also the former CEO, Bert Choong has sold his 50,482,000 shares of ND (23.0%) to Grand Slam. Grand Slam is holding 64.3% of the shares in ND so they need to garner about 25.7% more shares to allow their ploy to go through (i.e. delist the company and exercise its right to compulsorily acquire the remaining 10% shares). The twenty largest shareholders make up about 90% of the shareholdings although there are few nominees in the list. Hence, it will be a tough fight for minority shareholders but it is definitely worthwhile to put up a fight and you can probably turn to SIAS to request their help to fight for more fairness in this transaction.

In Conclusion, this is an unfair offer price in my opinion and the management should reconsider to increase the offer price to be fairer to other shareholders. If the company is to be liquidated today, it is almost certain that the liquidation value will fetch more than S$0.51. Minority shareholders, put up a strong fight and show the management that you are no pushovers!!!

Disclosure: I have no positions in any stocks mentioned, and no plans to initiate any positions within the next 72 hours.I wrote this article myself, and it expresses my own opinions. I am not receiving compensation in return. I have no business relationship with any company whose stock is mentioned in this article.

THE V.I.K

A Blog about my investing journey and any undervalued companies under little coverage!

DISCLAIMER

The information stated in The Value Investing Knight ("The Blog") should not be used as a reference to buy or sell any securities, assets or commodities mentioned. Readers should carry out their own due diligence and validation of any information shown in The Blog. The owner of The Blog is not liable for any loss arising directly or indirectly as a result of actions taken based on ideas and information found in The Blog.

Thursday, 4 May 2017

Sunday, 5 February 2017

How to make Good Investments

As investors, we are always seeking returns for our investments. In the broad definition, a good investment is an investment one can achieve returns above or at least equal to his expected returns. From a corporate's perspective, it is rather straightforward to define what is a good investment as the returns from the investments must be able to cross the hurdle rate which could be the Weighted Average Cost of Capital (In simple terms, this is cost of funds to gather cash for the investment or you can view it as the risks of the new investment) of the prospective investment before the company will decide to go ahead with the investment.

IN SUMMARY

What about from a retail investor's point of view? How do we decide what is a good investment?

Do we also apply the methodology used by corporate? Yes, this is one approach so we have analysts who will attempt to forecast the companies' future cash flows and apply Discounted Cash Flow Valuation (DCF) to calculate the intrinsic share price. If the computed intrinsic share price is higher than the current share price, it will be termed as a "Buy". To give all due respect to all the analysts who work so hard to forecast the future cash flows of the companies BUT there is no one who can predict accurately what lies in the future, not even the insiders of the company. Of course there are companies that have very stable earnings in the past so the trend may most likely continue in the near future. Therefore, the future cash flows of such companies may be projected much easier than some others. Having said that, DCF is only effective when there is a longer stream of cash flows (i.e. more than 5) so the projection of cash flows beyond 3 years will be subjected to much higher inaccuracy level even for companies with past stabilized cash flows.

My point here is as retail investors, we should forget about trying too hard to forecast the future performance of the companies, especially when we are not experts in the industry or sector because they will most likely be off just like how analysts try to predict the results of Brexit and US presidential elections. However, it may be a good thing to have an estimated valuation of the company if it is assumed that the current business operations will continue forever.

So how do we as retail investors make good investments then?

Personally, I view that one of the focal points is to make investments when there is HIGH MARGINS OF SAFETY between the intrinsic value and the current market value. This term was widely used by Benjamin Graham and his follower, Warren Buffet. High margin of safety does not guarantee returns but at least it greatly reduces the impact from forecasting errors. Since we may not be able to forecast the intrinsic value, we should always use book value as a cross check. If we can invest in a company below its intrinsic value and book value, then it should turn out as a rather good investment.

For example, one can buy into a fundamentally strong company when its share price is severely beaten down due to specific news which does not have a strong impact on its business such as broad market selldown due to Brexit. Buying below historical average Price to Book or Price to Earnings ratio is also an approach of investing with high safety of margins.

The other focal point is to enter into investments with HIGH INVESTMENT MOATS. Companies with high investment moats are able to defend their market share because their competitive edges are too strong for their competitors to overcome. Such companies have very good corporate strategies to protect their investment moats. I have to admit that I am still learning to identify such companies because it is not easy to look at business models and identify the economic moats that are accompanied in them. One of such examples is Google being the market leader in search engines and online advertising avenues. The strong competitive edge it holds will require a long time for its peers to catch up but there is no everlasting investment moats unless capitalism is destroyed. An example is Nokia whose investment moats slowly got eroded without them knowing and when they realised it, everyone is already using smart phones. A piece of advice for those who may not be able to identify investment moats easily, focus more on high margins of safety first because this will allow one to buy cheap companies.

Next question is probably on the time frame for these investments to reap the returns we are seeking for before they are considered as good investments?

We may be able to buy companies at a high margin of safety and with high investment moats but will the value be uncovered within the time frame we expected? For some of these investments, we may need to wait for years before the values can be realised. Hence, investors will have to be patient enough before the value can be uncovered by some catalysts along the way and this will depend on the timing of investments.

If you have bought Sabana Reit like the Financial Blogger, 3Fs, you are sitting on very good returns on your investments because the catalysts may come very soon such as in the case of Sabana Reit when the REIT manager announced that they are looking into strategic review together with the Sponsor, Vibrant Group. Not saying Sabana Reit is a good company but it is definitely a good investment for some like 3Fs because of the high margin of safety and good timing (but not high investment moats). Personally, I also contemplated on investing in Sabana Reit because my initial thoughts are that it may be beaten to a share price which does not justify its Net Asset Value (NAV). Afterall, it is a REIT with physical industrial properties in Singapore that should be priced at market valuations close to the NAV. But at that time, I do not think the catalyst will come anytime soon and the actions of the REIT manager are just not justifiable for me to execute my sword of value.

For some other catalysts, it may take a longer time. One such example is probably Chuan Hup Holdings (I have a recent post on them - My First Rescue). If you are an investor who have invested in Chuan Hup much earlier like T.U.B Investing, the waiting for the catalyst may be longer even though I believe the value will be uncovered soon. Note: I am also vested in Chuan Hup recently after reading about the potential Reverse Takeover Transaction. For more details, refer to the announcements here.

Of course, the best case scenario will be perfect timing of the investments with the catalysts to unlock the value of the companies. This may be more of luck than skills as no one can consistently catch the lowest points. However, one may be able to turn to Technical Analysis to time the entries and exits of investments. I may be writing a post on this in the future so stay tuned!

As value investors, we should always be looking out for companies with high margins of safety and high investment moats. At the same time, we also need to pay attention to the timing of our investments so to try minimize the waiting game for value to be unlocked. As long as one is patient enough and the investment analysis is sound, the value of undervalued companies will be unlocked ultimately.

For now, let's continue on our Value Investing Knighthood to search for undervalued companies and sharpen our swords for the next execution.

The V.I.K

Wednesday, 1 February 2017

You may need their services when you move house

First of all, I wish all of you a HAPPY CHINESE NEW YEAR and may the year of the Rooster be a better year for you! Let's HUAT together in this value investing knighthood!

Today the focus will be on one of the largest players in interior design (ID) and luxury furniture supplier in Singapore, Nobel Design Holdings Ltd (SGX:547). Nobel Design (ND) also has business operations in furniture supply chain distribution and property development. The supply chain distribution is operated by ND's 73.15% owned subsidiary, Buylateral Group which provides contemporary and classical furniture as well as home accessories from Asia to the major retailers in the United States (USA). In the property development front, ND has partnered Joint Ventures (JV) to tap on the expertise of its JV partners to develop mainly residential properties in Singapore although they have their first investment foray into hotels and retail property (i.e. Macpherson Mall: to be TOP in Dec 2018). Other than Singapore, they have also invested in their first London property - 163 unit turnkey apartment project at Marine Wharf East in May 2014. Now, let's explore the factors that make this a princess you may consider rescuing.

1. Cash Is King

As at 30 Sep 2016, ND is in a net cash position of SG$115.6m, 33% more than its total market capitalisation. The Net Current Asset Value, NCAV (Current Assets - Total Liabilities) is SG$119.9m, 37% more than the total market capitalisation. Such a high cash balance implies that if you buy ND today (i.e. 31 Jan 2017) at SG$0.41 and if the company enters into a liquidation the next day, you are still entitled to receive SG$0.56 per share after the company pays off its liabilities, assuming the company can easily liquidate its current assets. This approximates 37% returns based on today's share price.Ernst & Young (EY), the auditors of ND appointed since Sep 2015, has issued a qualified audit report for FY2015 as they were not able to ascertain the inventory amounts at the start of FY2015. Below is a screenshot on their basis for the qualified audit report.

Even if all other assets including inventories are not considered in the liquidation example, the company will still be able to repay all liabilities using its latest cash balances and result in a NCAV of SG$0.39 per share. That is only 6% below the current share price. Below is the summary of the numbers I have mentioned above.

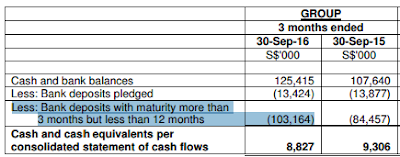

The next important consideration is whether these cash balances are existent. As disclosed in Q3 2016 financials, the company is placing most of their cash (SG$103.1m) in fixed deposits with maturity more than 3 months but not longer than 12 months. As they are bank deposits, the auditors can ascertain existence easily by sending bank confirmations, hence these cash balances are unlikely to be placed in bogus accounts.

2. Negative Enterprise Value

ND has a negative Enterprise Value (Total Market Capitalisation + Total Preferred Shares + Total Market Debt + Non-Controlling Interests - Total Cash and Cash Equivalents) of minus SG$23.5m due to the high cash balances. What does this imply? If a company acquires ND, not only does it not need to pay any cash, it will still be able to pocket SG$23.5m. Where can we find such a good lobang?? Such companies are very rare in today's context.Therefore, ND may be a potential acquisition target for companies wanting to achieve a foothold in Singapore's ID and furniture business or USA's furniture supply chain distribution. However, we have to be careful as there may be off-balance sheet debt such as committed operating leases of SG$21.3m (this will be lower in present value terms) over the next 5 years. Refer to the note below as extracted from the Annual Report 2015.

We also have to consider contingent liabilities such as corporate guarantees of SG$109.5m given to banks in relation to credit facilities of JV which may be potentially claimed against the company in the future. At this point, ND claimed that the JVs are in net assets position and are profitable so the probability of contractual outflows may be remote. Refer to the note below as extracted from the Annual Report 2015.

3. Insider buying

Besides the high valuation, there were insider buying activities in the past 3 months which is also another consideration point to wield our swords of value. The exercise price of the last tranche of Employee Share Options (ESOs) is SG$0.40. Hence, this indicates insiders' optimism on NB's outlook as ESOs were exercised near to the current share price.

The CEO, Terence Goon has bought 409,000 shares at SG$0.40 per share on 18 Jan 2017. The table below summarizes other insider buying activities, with total recent investment amounting to SG$2.3m and weighted average share price transacted at SG$0.357.

If ND has such a rich valuation as compared to its share price, why hasn't its share price corrected? Here are my two cents.

Corporate Governance Issues

The FY2014 financial statements were revised mainly due to the inappropriate application of new accounting standards, FRS111 on how the Joint Ventures' (JV) financials were presented. Before the revised FS, ND used proportionate consolidation (i.e. line by line item consolidation) which implies that the assets and liabilities would be higher. After the revision, the JVs are accounted using the equity method and only 1 line item each will be presented in the Profit and Loss (i.e. Share of profits from JV) and the Balance Sheet (i.e. Investment in JV). The shareholders were not impressed with the competence of the Audit Committee.

The former Chairman and founding member of ND, Mr Bert Choong was ousted out of the Board room in Mar 2013 as the CEO and other directors had alleged that Mr Choong conducted himself in a manner prejudicial to the interests of the group and in breach of his fiduciary duties. In return, Mr Choong sued the CEO and 3 other directors for defamation to prove his innocence. Fortunately, this boardroom tussle and lawsuit has come to an end after the concerned parties have decided to settle amicably outside the courts.

ND has also changed auditors to EY from Nexia TS after a short span of less than 4 years. This may imply that the accounting process may not be that robust and accounting personnel may not be competent enough. In fact, I have spotted a few minor inconsistencies in the latest annual report myself.

Hence, ND has a mountain to cross to gain back the trust of the shareholders and market in order for its value to be uncovered.

Negative Business Outlook

Due to lower luxury property sales in recent years, the ID and furniture sales were greatly affected. Besides, more families are buying furniture from overseas or through e-commerce. This is an industry disruption to the furniture suppliers and ND was not spared from the slowing market. As at 31 Dec 2015, contribution from the ID and furniture sales segment made up about 60% of the total adjusted EBITDA (Earnings before interests, taxes, depreciation and amortisations, share of profits from associates and JV). The adjusted EBITDA from ID and furniture sales have been reducing over the years and the 5-Year Compounded Annual Growth Rate (CAGR) is -11.4%. Therefore, the management has to seek new business opportunities in property development or furniture supply chain distribution.

Capital Misallocation

Over the recent years, ND has not been very generous with their dividends as shown in the table below. Shareholders or potential investors may be discouraged by the fact that ND has been hoarding its cash and cash equivalents for the past few financial years and excess cash is sitting in fixed deposits which probably generates less than 2% interest. This does not optimize cash returns and if there are no value-accretive projects in sight which can meet the company's WACC (weighted average cost of capital), the management and board should consider to increase the dividends so shareholders can plough the cash into investments that can generate higher returns. We may need an activist investor to urge the management to return the excess cash to shareholders, just like what happened to Metro Singapore.

In conclusion, Nobel Design is a company with value to be unlocked from the high net cash position but the company has some room for improvement in its corporate governance and capital allocation. Will this be a princess you are willing to rescue? You probably have to make a decision by weighing the pros and cons discussed above. Please also note that this company is much more illiquid than Chuan Hup so beware of a potential value trap. (Stock price remains low or can go even lower although there is value to be unlocked)Please feel free to post any comments and questions you have or subscribe to the VALUE INVESTING KNIGHT if you think the post is worth your time.

Disclosure: I have no positions in any stocks mentioned, and no plans to initiate any positions within the next 72 hours.I wrote this article myself, and it expresses my own opinions. I am not receiving compensation in return. I have no business relationship with any company whose stock is mentioned in this article.

THE V.I.K

Today the focus will be on one of the largest players in interior design (ID) and luxury furniture supplier in Singapore, Nobel Design Holdings Ltd (SGX:547). Nobel Design (ND) also has business operations in furniture supply chain distribution and property development. The supply chain distribution is operated by ND's 73.15% owned subsidiary, Buylateral Group which provides contemporary and classical furniture as well as home accessories from Asia to the major retailers in the United States (USA). In the property development front, ND has partnered Joint Ventures (JV) to tap on the expertise of its JV partners to develop mainly residential properties in Singapore although they have their first investment foray into hotels and retail property (i.e. Macpherson Mall: to be TOP in Dec 2018). Other than Singapore, they have also invested in their first London property - 163 unit turnkey apartment project at Marine Wharf East in May 2014. Now, let's explore the factors that make this a princess you may consider rescuing.

1. Cash Is King

As at 30 Sep 2016, ND is in a net cash position of SG$115.6m, 33% more than its total market capitalisation. The Net Current Asset Value, NCAV (Current Assets - Total Liabilities) is SG$119.9m, 37% more than the total market capitalisation. Such a high cash balance implies that if you buy ND today (i.e. 31 Jan 2017) at SG$0.41 and if the company enters into a liquidation the next day, you are still entitled to receive SG$0.56 per share after the company pays off its liabilities, assuming the company can easily liquidate its current assets. This approximates 37% returns based on today's share price.Ernst & Young (EY), the auditors of ND appointed since Sep 2015, has issued a qualified audit report for FY2015 as they were not able to ascertain the inventory amounts at the start of FY2015. Below is a screenshot on their basis for the qualified audit report.

Even if all other assets including inventories are not considered in the liquidation example, the company will still be able to repay all liabilities using its latest cash balances and result in a NCAV of SG$0.39 per share. That is only 6% below the current share price. Below is the summary of the numbers I have mentioned above.

The next important consideration is whether these cash balances are existent. As disclosed in Q3 2016 financials, the company is placing most of their cash (SG$103.1m) in fixed deposits with maturity more than 3 months but not longer than 12 months. As they are bank deposits, the auditors can ascertain existence easily by sending bank confirmations, hence these cash balances are unlikely to be placed in bogus accounts.

|

| As disclosed in 30 Sep 2016 Financials |

ND has a negative Enterprise Value (Total Market Capitalisation + Total Preferred Shares + Total Market Debt + Non-Controlling Interests - Total Cash and Cash Equivalents) of minus SG$23.5m due to the high cash balances. What does this imply? If a company acquires ND, not only does it not need to pay any cash, it will still be able to pocket SG$23.5m. Where can we find such a good lobang?? Such companies are very rare in today's context.Therefore, ND may be a potential acquisition target for companies wanting to achieve a foothold in Singapore's ID and furniture business or USA's furniture supply chain distribution. However, we have to be careful as there may be off-balance sheet debt such as committed operating leases of SG$21.3m (this will be lower in present value terms) over the next 5 years. Refer to the note below as extracted from the Annual Report 2015.

We also have to consider contingent liabilities such as corporate guarantees of SG$109.5m given to banks in relation to credit facilities of JV which may be potentially claimed against the company in the future. At this point, ND claimed that the JVs are in net assets position and are profitable so the probability of contractual outflows may be remote. Refer to the note below as extracted from the Annual Report 2015.

3. Insider buying

Besides the high valuation, there were insider buying activities in the past 3 months which is also another consideration point to wield our swords of value. The exercise price of the last tranche of Employee Share Options (ESOs) is SG$0.40. Hence, this indicates insiders' optimism on NB's outlook as ESOs were exercised near to the current share price.

The CEO, Terence Goon has bought 409,000 shares at SG$0.40 per share on 18 Jan 2017. The table below summarizes other insider buying activities, with total recent investment amounting to SG$2.3m and weighted average share price transacted at SG$0.357.

If ND has such a rich valuation as compared to its share price, why hasn't its share price corrected? Here are my two cents.

Corporate Governance Issues

The FY2014 financial statements were revised mainly due to the inappropriate application of new accounting standards, FRS111 on how the Joint Ventures' (JV) financials were presented. Before the revised FS, ND used proportionate consolidation (i.e. line by line item consolidation) which implies that the assets and liabilities would be higher. After the revision, the JVs are accounted using the equity method and only 1 line item each will be presented in the Profit and Loss (i.e. Share of profits from JV) and the Balance Sheet (i.e. Investment in JV). The shareholders were not impressed with the competence of the Audit Committee.

The former Chairman and founding member of ND, Mr Bert Choong was ousted out of the Board room in Mar 2013 as the CEO and other directors had alleged that Mr Choong conducted himself in a manner prejudicial to the interests of the group and in breach of his fiduciary duties. In return, Mr Choong sued the CEO and 3 other directors for defamation to prove his innocence. Fortunately, this boardroom tussle and lawsuit has come to an end after the concerned parties have decided to settle amicably outside the courts.

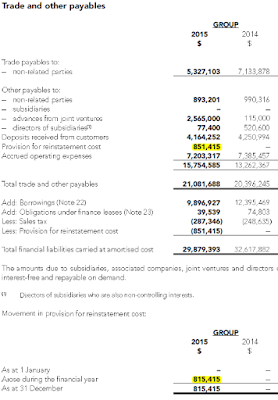

ND has also changed auditors to EY from Nexia TS after a short span of less than 4 years. This may imply that the accounting process may not be that robust and accounting personnel may not be competent enough. In fact, I have spotted a few minor inconsistencies in the latest annual report myself.

|

| Provision for reinstatement costs seems to be inconsistent. Just trying to prove my point but it is a minor error |

Negative Business Outlook

Due to lower luxury property sales in recent years, the ID and furniture sales were greatly affected. Besides, more families are buying furniture from overseas or through e-commerce. This is an industry disruption to the furniture suppliers and ND was not spared from the slowing market. As at 31 Dec 2015, contribution from the ID and furniture sales segment made up about 60% of the total adjusted EBITDA (Earnings before interests, taxes, depreciation and amortisations, share of profits from associates and JV). The adjusted EBITDA from ID and furniture sales have been reducing over the years and the 5-Year Compounded Annual Growth Rate (CAGR) is -11.4%. Therefore, the management has to seek new business opportunities in property development or furniture supply chain distribution.

|

| As extracted from the segment information note in the Annual Reports from the past 5 years |

Over the recent years, ND has not been very generous with their dividends as shown in the table below. Shareholders or potential investors may be discouraged by the fact that ND has been hoarding its cash and cash equivalents for the past few financial years and excess cash is sitting in fixed deposits which probably generates less than 2% interest. This does not optimize cash returns and if there are no value-accretive projects in sight which can meet the company's WACC (weighted average cost of capital), the management and board should consider to increase the dividends so shareholders can plough the cash into investments that can generate higher returns. We may need an activist investor to urge the management to return the excess cash to shareholders, just like what happened to Metro Singapore.

|

| As extracted from Annual Reports and SGX Cafe |

Disclosure: I have no positions in any stocks mentioned, and no plans to initiate any positions within the next 72 hours.I wrote this article myself, and it expresses my own opinions. I am not receiving compensation in return. I have no business relationship with any company whose stock is mentioned in this article.

THE V.I.K

Sunday, 22 January 2017

My First Rescue

This will be my first post to write about an undervalued company and I hope to rescue this "Princess" as the Value Investing Knight. Such companies do not receive much attention from the masses, but they may jolly well turn out to be uncovered gems.

This company is CHUAN HUP HOLDINGS LIMITED (SGX:C33). I will use CH as the abbreviation in this post.

CH's main business activities are electronics manufacturing services and property development after disposing of their shareholdings in their associate company, CH Offshore back in FY2015. That explains the special dividends of SG$0.02 per share distributed in FY2016.

On hindsight, the call to dispose the stake in its offshore marine business was a good move, considering the fall in share price from the offer price of SG$0.55 to today's price at SG$0.24. This divestment aside, there are 3 strong points worthy for us to raise our Value Sword.

1. Price to Book (PB) Ratio at 5 year historical low

As shown by the green line in the Bloomberg Chart above, the current PB ratio of 0.54 is even lower than 0.55 in June 2012.

2. Net Cash is at 50% of the Market Capitalisation, Net Current Asset Value, NCAV is almost 100% of the Market Cap

CH's management (Peh's family) has been very conservative and it has always been in a net cash position. The current net cash as at 30 Sep 2016 is USD77m while the market cap is approx. USD154m as at 20 Jan 2017. If we were to add Short Term Investments of USD32m to net cash, the % of market cap will increase to 70%. The reason for the inclusion is Short Term Investments are almost as liquid as cash equivalents.

Adding some toppings to the ice cream, the NCAV (Current Assets minus Total Liabilities) is USD150m which is 96% of the market cap. The Father of Value Investing, Benjamin Graham used this approach to value companies and found his set of undervalued companies.

Given that CH has investment properties, investment in associates (i.e. An Australian property developer, Finbar group) and Available For Sale (AFS) investments under Non-Current Assets in the Balance Sheet, these additional value should be priced into the share price. Hence, the potential upside is around SG$0.15.

I have summarised the above into a table which should be more visually helpful. For those who just started out in your investing journey, it will be good to google the definition of any financial terms that you are unfamiliar with. Investopedia will be a good reference.

3. Positive Operating Cash Flows for the past 5 years

As shown above in the Bloomberg's screenshot (please note that the numbers above are different from those reported in Annual Reports as these are standardised version), CH has positive operating cash flows since FY2012 except for the recent FY. Cash Flow Statements are much more difficult to manipulate as compared to Income Statements and given the fact that CH has been paying out dividends of SG$0.01 per share (relatively good dividend yield of 4.3% at current price) since FY2012, there are strong grounds to believe that the company is generating operating cash flows. Back to FY2016, when one looks under the Cash Flow Statements, it is realised that the negative operating cash flow is due to the increase in held for trading activities of USD20m as highlighted below. Hence, the reason for the negative operating cash flows is not due to underlying business operations. Personally, I would think they should be classified under investing activities because these are not the true operating activities of CH.

The operating cash flows are also supported by the steady operations from its 76.7% owned subsidiary in Electronics Manufacturing, PCI Limited. PCI has been generating positive operating cash flows for the past 10 years. Electronics manufacturing may not be the most exotic industry to be in but this business is definitely providing the stable cushion for CH given the more cyclical nature of property development.

Besides the above 3 points, one can still explore further into the following factors but I will not be elaborating much into them for now:

Management

Terence Peh is the CEO. The CFO and Head, Corporate Development were previously from Straits Trading. All 3 of them graduated with Degrees in Accountancy (may be a downside given that there is no other unique view)

Corporate Governance

Peh's family owns more than 50% of the shareholdings in the company.

The Chairman is a Non-executive Director and an Independent Director. However, the independent directors only represent 40% of the board members. Once again, most of the board members graduated with Accountancy degrees.

Competitors

The closer SGX listed competitors for the Electronics Manufacturing segment is CEI Limited and PNE Industries (PCI does not seem to be performing well in terms of ROE against these peers but more analysis needs to be performed to understand better)

For property development segment, smaller property developers such as Oxley and Roxy-Pacific can be used as closer competitors. (CH seems to be more value for price in this case)

Future business outlook

Will the margins for Electronics Manufacturing be getting lower or will the property sales in Australia and Philippines be lower than before? These are some questions one may want to ask.

Then, you can make your final decision on whether it is time to wield your Value of Swords. I have struck to rescue this princess to my fortress as she has been neglected for a long time. It will require some time for her to recuperate before she turns into Snow White again.

In summary, retail investors like us do not always need to follow those big banks' analysts or institutional investors to invest in value companies. You can follow your own value investing approach or follow the Value Investing Knight to uncover them. Most importantly, we must seek fulfillment from this process and attain knighthood in this long journey!

REMEMBER THE KNIGHTHOOD FORMULA:

Have an awesome start at work tomorrow! Happy Chinese New Year in advance if my next post does not come in time.

Please feel free to post any comments and questions you have. I will try to answer as soon as possible.

This company is CHUAN HUP HOLDINGS LIMITED (SGX:C33). I will use CH as the abbreviation in this post.

CH's main business activities are electronics manufacturing services and property development after disposing of their shareholdings in their associate company, CH Offshore back in FY2015. That explains the special dividends of SG$0.02 per share distributed in FY2016.

On hindsight, the call to dispose the stake in its offshore marine business was a good move, considering the fall in share price from the offer price of SG$0.55 to today's price at SG$0.24. This divestment aside, there are 3 strong points worthy for us to raise our Value Sword.

1. Price to Book (PB) Ratio at 5 year historical low

2. Net Cash is at 50% of the Market Capitalisation, Net Current Asset Value, NCAV is almost 100% of the Market Cap

CH's management (Peh's family) has been very conservative and it has always been in a net cash position. The current net cash as at 30 Sep 2016 is USD77m while the market cap is approx. USD154m as at 20 Jan 2017. If we were to add Short Term Investments of USD32m to net cash, the % of market cap will increase to 70%. The reason for the inclusion is Short Term Investments are almost as liquid as cash equivalents.

Adding some toppings to the ice cream, the NCAV (Current Assets minus Total Liabilities) is USD150m which is 96% of the market cap. The Father of Value Investing, Benjamin Graham used this approach to value companies and found his set of undervalued companies.

Given that CH has investment properties, investment in associates (i.e. An Australian property developer, Finbar group) and Available For Sale (AFS) investments under Non-Current Assets in the Balance Sheet, these additional value should be priced into the share price. Hence, the potential upside is around SG$0.15.

I have summarised the above into a table which should be more visually helpful. For those who just started out in your investing journey, it will be good to google the definition of any financial terms that you are unfamiliar with. Investopedia will be a good reference.

3. Positive Operating Cash Flows for the past 5 years

As shown above in the Bloomberg's screenshot (please note that the numbers above are different from those reported in Annual Reports as these are standardised version), CH has positive operating cash flows since FY2012 except for the recent FY. Cash Flow Statements are much more difficult to manipulate as compared to Income Statements and given the fact that CH has been paying out dividends of SG$0.01 per share (relatively good dividend yield of 4.3% at current price) since FY2012, there are strong grounds to believe that the company is generating operating cash flows. Back to FY2016, when one looks under the Cash Flow Statements, it is realised that the negative operating cash flow is due to the increase in held for trading activities of USD20m as highlighted below. Hence, the reason for the negative operating cash flows is not due to underlying business operations. Personally, I would think they should be classified under investing activities because these are not the true operating activities of CH.

Besides the above 3 points, one can still explore further into the following factors but I will not be elaborating much into them for now:

Management

Terence Peh is the CEO. The CFO and Head, Corporate Development were previously from Straits Trading. All 3 of them graduated with Degrees in Accountancy (may be a downside given that there is no other unique view)

Corporate Governance

Peh's family owns more than 50% of the shareholdings in the company.

The Chairman is a Non-executive Director and an Independent Director. However, the independent directors only represent 40% of the board members. Once again, most of the board members graduated with Accountancy degrees.

Competitors

The closer SGX listed competitors for the Electronics Manufacturing segment is CEI Limited and PNE Industries (PCI does not seem to be performing well in terms of ROE against these peers but more analysis needs to be performed to understand better)

For property development segment, smaller property developers such as Oxley and Roxy-Pacific can be used as closer competitors. (CH seems to be more value for price in this case)

Future business outlook

Will the margins for Electronics Manufacturing be getting lower or will the property sales in Australia and Philippines be lower than before? These are some questions one may want to ask.

Then, you can make your final decision on whether it is time to wield your Value of Swords. I have struck to rescue this princess to my fortress as she has been neglected for a long time. It will require some time for her to recuperate before she turns into Snow White again.

In summary, retail investors like us do not always need to follow those big banks' analysts or institutional investors to invest in value companies. You can follow your own value investing approach or follow the Value Investing Knight to uncover them. Most importantly, we must seek fulfillment from this process and attain knighthood in this long journey!

REMEMBER THE KNIGHTHOOD FORMULA:

VALUE = PRICE + RETURNS

Have an awesome start at work tomorrow! Happy Chinese New Year in advance if my next post does not come in time.

Please feel free to post any comments and questions you have. I will try to answer as soon as possible.

THE V.I.K

More about the Knight

Welcome to my first post! Starting an investing blog has always been one of my resolutions and I decided to take up this challenge and fulfill it this year. Though late, but better late than never! Why the name Value Investing Knight? A knight to me is righteous and I hope to be the one to uncover mispricings in deep value companies and rescue these princesses (companies), bearing in mind the formula:

VALUE = PRICE + RETURNS

A brief background about Myself:

I am in my early 30s and am a typical Singaporean white collar employee who holds a 9 to 6 (occasionally longer) job. I always hold the belief that investment income should supplement our future retirement needs. One can buy into insurance savings or endowment plans to accumulate wealth over time but I want to shoulder this responsibility myself so I embarked on this investing quest immediately after graduation and aspire to become the full-fledged VALUE INVESTING KNIGHT as time goes by.

I graduated with a degree in Bachelor of Accountancy at one of the local universities. Having worked for more than 5 years, I have gained experience in different aspects of finance including Auditing, Accounting, Corporate Finance and Treasury. I am also a Chartered Accountant (Singapore) and completed the Chartered Financial Analyst course (expected to attain the charter in 2017). Even with these credentials, I have to admit that personal investing is a different ball game altogether and I am still learning from my knocks along the quest. There is investing psychology and personal biases which one has to deal with. The same piece of information can be viewed very differently by two investors and that is the beauty of investing. However, the investing approach can be more scientific and structured to ensure that there is a basis for each investment idea and the way an investor uncovers value in companies.

In this blog, I will be writing about my investing quest to uncover deep value companies and any of my other investing encounters. As a start, I will be blogging about SGX listed companies but I would like to extend the list to overseas listed companies as I become more seasoned in this.

My main objectives in setting up this blog:

The V.I.K (VALUE INVESTING KNIGHT)

VALUE = PRICE + RETURNS

A brief background about Myself:

I am in my early 30s and am a typical Singaporean white collar employee who holds a 9 to 6 (occasionally longer) job. I always hold the belief that investment income should supplement our future retirement needs. One can buy into insurance savings or endowment plans to accumulate wealth over time but I want to shoulder this responsibility myself so I embarked on this investing quest immediately after graduation and aspire to become the full-fledged VALUE INVESTING KNIGHT as time goes by.

I graduated with a degree in Bachelor of Accountancy at one of the local universities. Having worked for more than 5 years, I have gained experience in different aspects of finance including Auditing, Accounting, Corporate Finance and Treasury. I am also a Chartered Accountant (Singapore) and completed the Chartered Financial Analyst course (expected to attain the charter in 2017). Even with these credentials, I have to admit that personal investing is a different ball game altogether and I am still learning from my knocks along the quest. There is investing psychology and personal biases which one has to deal with. The same piece of information can be viewed very differently by two investors and that is the beauty of investing. However, the investing approach can be more scientific and structured to ensure that there is a basis for each investment idea and the way an investor uncovers value in companies.

In this blog, I will be writing about my investing quest to uncover deep value companies and any of my other investing encounters. As a start, I will be blogging about SGX listed companies but I would like to extend the list to overseas listed companies as I become more seasoned in this.

My main objectives in setting up this blog:

- To record down my investing quest and blog about companies with deep value

- To create more awareness about long-term investing for retirement needs

- To connect and meet more like-minded value investors so we can learn from each other

I do not want to restrict myself in setting the number of posts each week/month. However, I will make it an effort to post a summary of each value investment idea I come across or any other interesting investing encounters I have. So meanwhile, stay tuned to see me wield my Sword of Value very soon! Have a great Sunday ahead!

The V.I.K (VALUE INVESTING KNIGHT)

Subscribe to:

Comments (Atom)